China's video game industry recorded its best quarter in full lockdown during the Covid-19. 10 billion euros were spent in this sector by Chinese players during Q1 2020, representing a 30% increase over same period last year.

We can point out two trends:

During lockdown, people have access to both their computers and smartphones. But mobile games account for 76% of the market with 46% growth. Concerning PC-based games have experienced a slight growth only.

More and more young Chinese women start playing: today 360 million Chinese players are women.

Today, China is the world's largest video game market with 41% of global market’s revenues. In 2019, 604 million mobile players were registered in China.

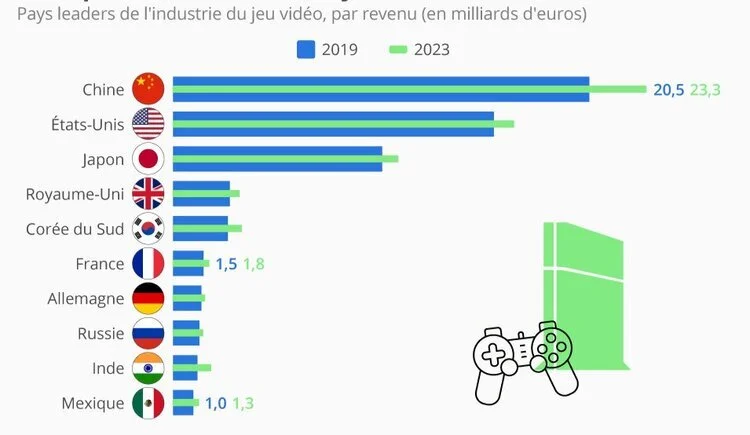

Top 10 countries in video game market (2019-2023)

Leader countries in the video game industry by revenue (Billion euros)

However, the Chinese government continues to control and define new regulations that shape the growth of this gaming industry.

In April 2020, the Chinese Communist Party (CCP) banned Chinese players from playing with their peers overseas or even chatting with them. The new strict CCP regulations also prohibit zombies, map editing, role-playing, and even organizing a union in a game.

As a result, many worldwide superstar games are banned in China:

Nintendo's superstar game "Animal Crossing" in which players create houses and interact with other cute villagers and animals. This game was used by some political activists to spread political messages, which was the reason behind its ban in China.

The "Plague", a British game, is also banned in China to avoid the illusion at Covid-19.

"Pokémon Go" is banned because the Chinese Authority considers this game a threat to the security of geographical data.

In fact, the Chinese government's history with the video game industry goes back a long time.

Indeed, it was the popularity of these video games that prompted the government to take an interest in it.

The Chinese government considers that video games are the reason why young people are increasingly confined in their homes and are going out less and less. As a measure to protect the social life of the young generation, the government bans minors under the age of 18 from playing games after 10pm. Thee budget that a player can spend in games has also been limited to 200 Yuan (26 Euros) per month for minors under 16.

Video game companies have been pushed to incorporate settings that allow parents to control the amount of time their children spend in the game. In fact, even teachers can be informed of the time their students spend playing. This is a strategy of the Chinese government to combat not only addiction but also the high rate of myopia observed among children whose cause, according to the government, is the long hours spent in front of video games. This can also be an educational strategy to encourage children to achieve a balance among education, entertainment and social life.

In addition, in 2018, the National Administration of Chinese Radio and Television has been ordered to closely monitor this sector. The country has also established an online gaming ethics committee to assess the content of these games and to judge whether it is in accordance with the social values of the party.

China had also launched a campaign against gaming sites whose content is considered "inappropriate". As a result, hundreds of games were investigated, and 45 games hosted abroad that operated without permission in China were blocked.

The policy is to monitor online games, which can be used to broadcast protest messages. Only organizations that receive permission from the Chinese government can legally operate video games. It should be noted that it doesn’t only concern gambling, but all types of games.

International growth drivers: an opportunity for European companies?

The EU's digital ambition to stimulate innovation, economic growth and progress means that the gaming ecosystem in Europe will play an increasingly vital role. Video games represent one of Europe's most compelling economic success stories and a rapidly growing segment of these creative industries.

And France seems to be a prime target of Chinese gaming giants.

In March 2018, Tencent, the number one video game company in China, and one of the BATX companies (Baidu, Alibaba, Tencent, Xiaomi), which has 90% market share in gaming with NetEase, has invested in Ubisoft (The French gaming company). While in January 2019, the second giant NetEase invested in the French studio Quantic Dream.

Yoozoo, a Chinese gaming company, acknowledges that sales outside China now account for more than 60% of their revenue.

In conclusion, while some points have yet to be clarified, China has indeed begun the transformation of the video game sector. This transformation is impacting the whole world and forcing a change on companies. Between adapting the type of content, seeking new markets, and transitioning to a new type of games (Esport for example), what strategies could compensate for the losses due to the new regulations?

Sources:

http://finance.eastmoney.com/a/202004201460475621.html

Chiffres sur le secteur des jeux en Chine:

https://www.statista.com/topics/4642/gaming-in-china/

https://www.wepc.com/news/video-game-statistics/

https://newzoo.com/insights/rankings/top-10-countries-by-game-revenues/

https://fr.statista.com/infographie/19896/leaders-du-marche-mondial-du-jeu-video-par-revenu/